Indicators on Chapter 7 - Bankruptcy Basics You Need To Know

Table of ContentsThe 9-Minute Rule for Tulsa Ok Bankruptcy AttorneyThe Best Guide To Tulsa Ok Bankruptcy AttorneyBankruptcy Attorney Tulsa Things To Know Before You BuyIndicators on Tulsa Ok Bankruptcy Attorney You Should KnowThe Bankruptcy Law Firm Tulsa Ok Diaries

The statistics for the other main type, Phase 13, are even worse for pro se filers. Suffice it to claim, talk with an attorney or two near you who's experienced with personal bankruptcy legislation.Numerous lawyers also supply totally free appointments or email Q&A s. Benefit from that. (The charitable application Upsolve can aid you locate cost-free examinations, sources and lawful help absolutely free.) Ask if personal bankruptcy is without a doubt the right selection for your scenario and whether they believe you'll qualify. Before you pay to submit personal bankruptcy forms and blemish your credit rating report for approximately 10 years, inspect to see if you have any type of viable choices like financial debt settlement or non-profit debt counseling.

Ad Now that you've chosen bankruptcy is indeed the ideal training course of action and you with any luck removed it with a lawyer you'll need to get started on the documentation. Prior to you dive right into all the main bankruptcy kinds, you must get your very own files in order.

4 Easy Facts About Bankruptcy Attorney Tulsa Explained

Later on down the line, you'll in fact require to verify that by divulging all kind of info about your financial events. Here's a standard listing of what you'll require on the roadway ahead: Recognizing records like your motorist's license and Social Protection card Income tax return (up to the past 4 years) Proof of revenue (pay stubs, W-2s, independent revenues, earnings from properties in addition to any type of revenue from federal government benefits) Bank statements and/or pension statements Evidence of worth of your possessions, such as car and genuine estate evaluation.

You'll want to understand what type of financial debt you're trying to resolve.

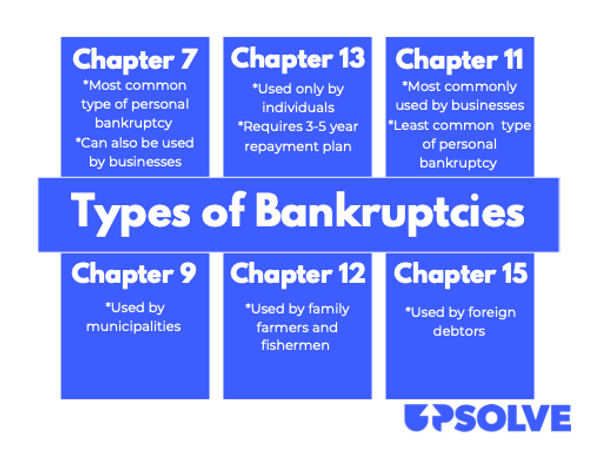

You'll want to understand what type of financial debt you're trying to resolve.If your income is expensive, you have another choice: Phase 13. This choice takes longer to resolve your financial obligations because it calls for a long-term settlement strategy normally three to five years before a few of your continuing to be financial debts are wiped away. The declaring process is additionally a great deal more complex than Chapter 7.

Some Known Facts About Affordable Bankruptcy Lawyer Tulsa.

A Chapter 7 insolvency remains on your credit rating report for 10 years, whereas a Phase 13 personal bankruptcy drops off after seven. Before you send your personal bankruptcy types, you need to first finish a compulsory course from a credit report therapy firm that has actually been approved by the Department of Justice (with the significant exemption of filers in Alabama or North Carolina).

The course can be finished online, in person or over the phone. You must complete the course within 180 days of filing for bankruptcy.

The Chapter 7 Bankruptcy Attorney Tulsa Ideas

A lawyer will typically manage this for you. If you're submitting on your very own, recognize that there are regarding 90 different bankruptcy districts. Check that you're submitting with the appropriate one based on where you live. If your permanent home has moved within 180 days of loading, you must bankruptcy lawyer Tulsa file in the district where you lived the greater part of that 180-day duration.

About Bankruptcy Lawyer Tulsa

If you go to risk of foreclosure and have actually worn down all various other financial-relief options, then submitting for Chapter 13 might delay the repossession and assist in saving your home. Ultimately, you will still require the income to continue making future mortgage settlements, along with paying off any type of late repayments throughout your layaway plan.

If so, you may be needed to give additional details. The audit could postpone any type of financial debt relief by a number of weeks. Certainly, if the audit shows up incorrect details, your instance can be disregarded. All that claimed, these are rather rare Get the facts circumstances. That you made it this far at the same time is a decent indication at least some of your financial obligations are qualified for discharge.

Comments on “Bankruptcy Attorney Tulsa for Beginners”